Policy Objectives

- Use of up-to-date life expectancy tables to calculate fortnightly DFRDB payments after commutation.

- Rectification of severe financial injustice caused using out-dated lifetables for half a century.

What is Commutation?

The Defence Force Retirement and Death Benefits Scheme (DFRDB) includes an arrangement called commutation. This allows retirees to take up to five years of their retirement pay as an initial lump sum, in exchange for a permanent reduction in their retirement pension.

The permanent reduction in pension is calculated by dividing the amount of lump sum, by an expectation of life factor. The expectation of life factor is the length of time a person of a given age is, on average, expected to live for past their retirement age.

John is a DFRDB member who is about to retire from the ADF at 50 years of age, with an annual pension of $40,000. John commutes five years of his pension, so received a lump sum of $200,000.

As a 50-year-old, John's expectation of life factor is 23.13.

John's annual pension is reduced by $8,647. His initial annual pension after commutation is $31,353.

What is the Financial Injustice?

The expectation of life factors used by DFRDB are based on life expectancy statistics from 1960-62. Since that time, the average life expectancy has increased by over ten years.

Using outdated expectation of life factors means that the average DFRDB retiree who commuted, has their pension reduced by an inflated amount, for a longer period too—a double hit.

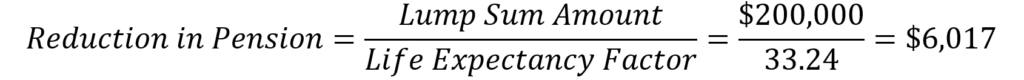

John is about to retire from the ADF aged 50 years in 2022 with an annual pension of $40,000. His life expectancy using ABS tables (2018-20) is 83.24 years. This translates to a life expectancy factor of 33.24.

John's annual pension should be reduced by $6,017, not by $8,647. His pension should be $33,983.

John will be penalised by $2,630 each year for commuting.

Commutation was intended to be cost neutral. Outdated lifetables mean the government receives a windfall at the expense of veterans.

How Should it be Fixed?

DFWA proposes a simple solution that is fair to both the DFRDB retiree and to the taxpayer.

- The DFRDB expectation of life factor must reflect the actual life expectancy of the member at the date he/she chose to commute. A simple legislative change is all that is needed. This is cost neutral.

- All living DFRDB members who commuted must have their pension reduction recalculated using their actual life expectancy at the time of their decision to commute.